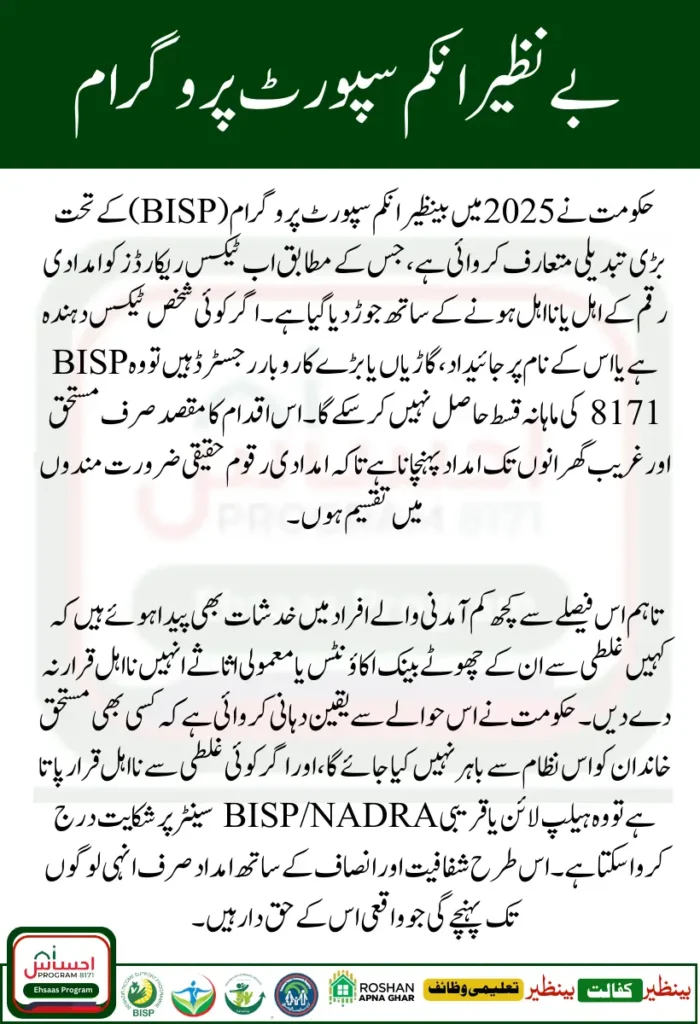

BISP 8171 Payments 2025 continues to provide monthly financial assistance to millions of families across Pakistan. However, a major policy update has now linked tax records with BISP 8171 payment eligibility.

The government announced that individuals who regularly pay income tax or own large properties, vehicles, or businesses will no longer qualify for financial aid. This step aims to filter out ineligible households and ensure that only the poorest families benefit from the program.

For many struggling families, this update brings both hope and concern. Hope, because it promises fairness in distribution; concern, because some low-income earners fear they may be wrongly excluded.

Government Announcements – Linking Tax Records to BISP

The Ministry of Poverty Alleviation and Social Safety confirmed that tax data from FBR (Federal Board of Revenue) will now be cross-checked with BISP records. This integration is part of the September 2025 reforms.

Key highlights of the announcement:

- Taxpayers are not eligible for BISP 8171 monthly stipends.

- Families owning vehicles, multiple bank accounts, or properties will be excluded.

- Women as primary recipients remain a priority for fair distribution.

- Complaint centers set up for those who feel wrongly disqualified.

This decision was made after reports showed that some relatively well-off families were receiving aid, while deserving poor households were left out.

You Can Also Read ; Ehsaas 8171 Program Update 2025

Support Money and Help Details of Families

BISP continues to provide monthly financial assistance to eligible families. The payment amount has been slightly adjusted for 2025 to meet rising inflation.

Here is a summary of the current BISP 8171 payment structure:

| Category | Eligibility | Monthly Stipend (PKR) | Additional Benefits |

| Extreme Poverty | No income, no assets, score below 20 | 12,000 | Free ration + Sehat Card |

| Low-Income Families | Score 21–35, no tax records | 9,000 | Subsidized electricity bills |

| Needy Households | Score 36–50 | 6,000 | Education stipends for children |

| Taxpayers / Property Owners | Linked to FBR records | Not Eligible | — |

This structure highlights how tax records now directly affect eligibility.

You Can Also Read :BISP Camp Sites Closed – Collect Payments

Relief & Support Operations

Alongside this new verification system, the government has strengthened its relief operations:

- Over 2 million families verified through FBR–BISP data integration.

- 300,000 ineligible beneficiaries removed from the system in 2025.

- Digital verification centers set up in 100 districts.

- Mobile vans launched to help rural families check their eligibility.

These operations ensure that relief funds go to the right people without middlemen.

Future Plans to Stop Problems of a Common Man

The government emphasized that BISP is not only about cash handouts but also about long-term poverty reduction. The new tax-linked reforms are part of a broader development strategy.

Planned measures include:

- Skill development training for unemployed youth.

- Interest-free loans for small businesses.

- Educational stipends to reduce school dropouts.

- Digital banking expansion to bring transparency to payments.

By filtering out ineligible families, more funds can be redirected to development and empowerment programs.

You Can Also Read : BISP 8171 Installment September 2025

Steps to Stop Corruption and Unfair Practices

Linking tax records with BISP eligibility is also a way to fight corruption.

- Fake beneficiaries removed from payment lists.

- Agents charging illegal fees arrested in multiple districts.

- FBR audits used to track fraudulent claims.

- Launch of helpline 0800-26477 for complaints.

This ensures that government support reaches only those who truly need it.

BISP 8171 Payments 2025 Impact on Families

For poor families, these changes bring mixed emotions.

- In Rural Sindh, a widow expressed relief that “only the poorest are now protected, and rich families will not take our share.”

- In Punjab, some daily-wage workers feared they might be excluded because their small bank accounts were flagged by mistake.

- The Prime Minister, in a televised message, assured citizens:

“No genuine poor family will be left out. The system is designed to protect the weakest and ensure fairness.”

This shows the human impact of the policy balancing fairness with compassion.

Conclusion

The BISP 8171 Payments 2025 update marks a major shift by linking tax records with eligibility. While this ensures fairness and prevents misuse, it also requires careful monitoring to avoid wrongful exclusions.The government’s relief operations, digital systems, and strict anti-corruption measures are strong steps toward a transparent and just welfare system.

For millions of poor families, this reform is a promise that their support will not be stolen by the wealthy.The future of BISP lies in digital verification, fairness, and empowerment helping families not only survive but also build better lives.

You Can Also Read : Check Your BISP Eligibility Status Online

FAQs

How do tax records affect BISP 8171 eligibility in 2025?

If you are a taxpayer or own property/vehicles, you will not be eligible for BISP payments.

How much financial support can eligible families receive?

Depending on poverty score, families receive Rs. 6,000 to Rs. 12,000 monthly.

What if I am wrongly marked ineligible?

You can file a complaint at the BISP helpline (0800-26477) or visit the nearest NADRA/BISP center.

Can women apply directly even if their husbands pay taxes?

No. If a household pays tax or owns property, the family becomes ineligible, regardless of who applies.

Are BISP payments still available in rural areas?

Yes. Mobile vans and digital centers in 100 districts make sure rural families can access support.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.