BISP Payment Block Tax Record

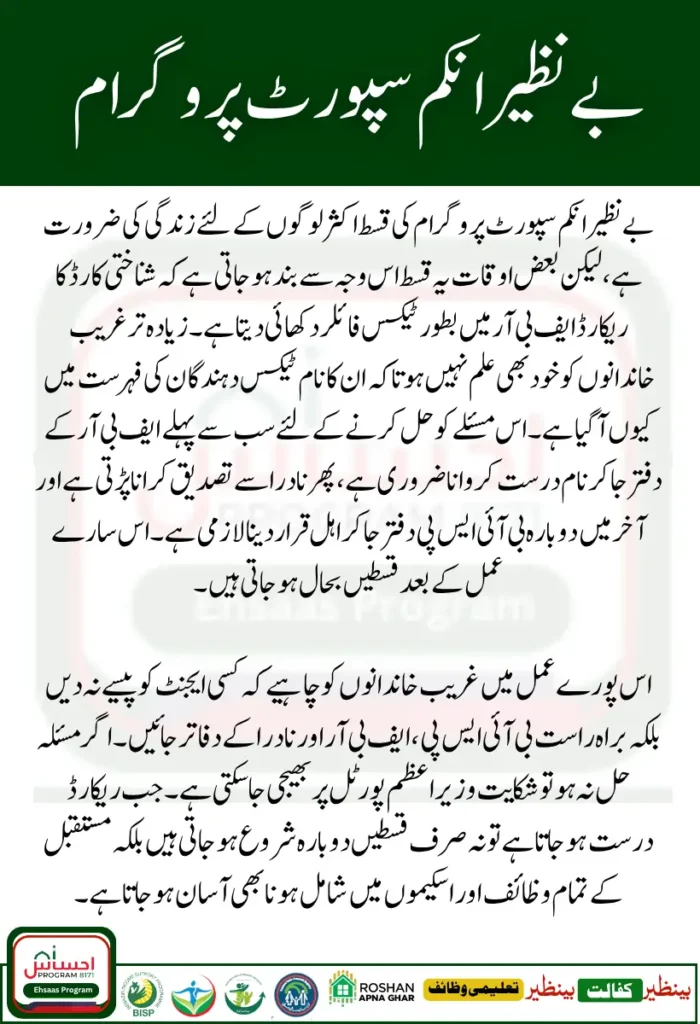

In Pakistan, millions of poor and deserving families depend on the BISP Payment Block Due to Tax Record Issues for their monthly financial aid. But many families recently faced a big problem: their BISP payment was blocked due to tax record issues. For poor households, this sudden stoppage becomes a major headache because money is often the only way to buy food, medicines, and pay school fees.

The government uses NADRA and FBR data to identify who really deserves the money. If your record shows that you paid tax, or you have property or business linked with your name, then your BISP payment can be blocked. In most cases, poor people do not even know why their CNIC is showing in the tax filer list. Sometimes a family member’s record or a technical mistake at FBR creates this issue. That’s why understanding the cause and fixing it step by step is very important.

Why Tax Record Blocks Happen

There are several reasons why BISP payments get stopped due to tax record mismatches. The government has created rules that only those families will get support who have no regular income, business, or tax status. If your CNIC is linked with any of these, the system automatically marks you as “ineligible.”

You Can Also Read ; How to Check BISP 8171 Payment with CNIC

Common reasons behind payment block:

- Your CNIC is showing in the FBR taxpayer list (even if by mistake).

- A family member with your address or household is listed as a filer.

- Technical error in NADRA or tax record databases.

- Someone registered property, car, or bank account under your CNIC.

- Your CNIC was once used for a business SIM, NTN, or GST number.

This may sound unfair, but the government is using digital checks to stop non-deserving families from receiving money. Still, for genuine poor people, there is always a process to fix this problem.

How to Fix BISP Payment Block

If your BISP payment has been blocked due to tax record issues, don’t worry. The process may take some time, but it can be solved. The most important thing is to understand that you need to clear your tax record and then re-verify your eligibility with BISP.

Step 1: Confirm the Issue

Go to the nearest BISP office or use the 8171 web portal and check the reason for your payment block. If the message shows “Tax Filer” or “FBR Record,” then you know the issue is with tax data.

Step 2: Visit FBR Office

Go to your nearest FBR Regional Tax Office (RTO). Ask them to check your CNIC in the taxpayer list. If you are wrongly marked as a filer, request them to remove your name.

Step 3: Submit an Application

Write a simple application stating that you are poor, not a taxpayer, and your BISP payment is blocked due to a mistake in records. Attach copies of CNIC, B-Form (if needed), and proof of income status.

Step 4: NADRA Verification

After clearing with FBR, go to NADRA office and verify your CNIC. Sometimes BISP requires “fresh biometric verification” to restart payments.

Step 5: Revisit BISP Office

Once your tax record is corrected, go back to the BISP office and request re-verification. They will forward your data for eligibility check. After approval, your payments will restart.

You Can Also Read : BISP Ineligible Families 2025

Required Documents for Fixing Issue

To solve the BISP payment block due to tax record issues, you should carry these documents:

- Original CNIC of applicant.

- Copy of family registration certificate (FRC) or B-Form.

- Written application for record correction.

- Proof of no income (optional but helpful).

- Any letter or slip from BISP showing your blocked status.

Offices You Need to Visit

- FBR Regional Tax Office (RTO): To remove your CNIC from the tax filer list.

- NADRA Office: For biometric verification and CNIC update.

- BISP Tehsil Office: For final re-verification and payment restart.

You Can Also Read : Good News Double BISP Payment 2025

Process of Fixing BISP Tax Record Block

| Step | Office to Visit | Purpose | Documents Needed |

| 1 | BISP Tehsil Office | Confirm reason of block | CNIC |

| 2 | FBR Regional Office | Remove CNIC from taxpayer list | CNIC, application |

| 3 | NADRA Office | Biometric & CNIC verification | CNIC, FRC |

| 4 | BISP Office | Re-verify eligibility & restart payment | CNIC, proof of correction |

Benefits of Fixing BISP Payment

Once you successfully fix your tax record issue, you will again receive BISP support without interruption. This means:

- Regular monthly support (Rs. 13,500 or updated amount).

- Eligibility for BISP Kafalat and Taleemi Wazaif schemes.

- Removal of stress and long waiting times.

- Proof that your record is clean in both FBR and BISP.

Extra Tips for Poor Families

- Always check your CNIC on 8171 portal after record correction.

- Do not pay any agent or middleman; all services are free in BISP, NADRA, and FBR.

- If your case is not solved, submit a written complaint at the Citizen Portal App or directly to the BISP helpline.

- Keep photocopies of all applications and acknowledgments for record.

FAQs

My BISP payment is blocked, but I never paid tax. Why?

This often happens if your CNIC is mistakenly included in FBR tax records. It can be due to property, SIM, or business registered in your name.

How long does it take to fix a BISP block?

If you visit FBR and NADRA on time, your payment can restart within 30–60 days after re-verification.

Can I solve the issue online?

No, currently you must visit FBR and BISP offices in person with documents.

Do I need a lawyer for tax correction?

No, poor families do not need a lawyer. A simple application and CNIC are enough. If the case is complicated, FBR officers will guide you.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.