What is BISP Sahulat Account 2025?

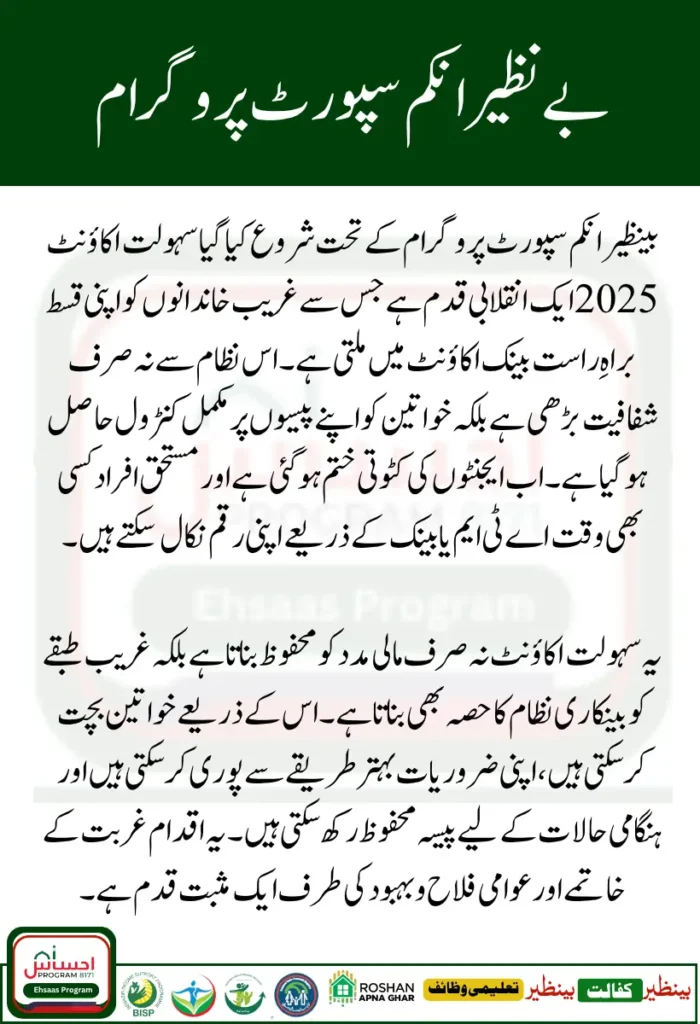

The Government of Pakistan has introduced the BISP Sahulat Account 2025 to make the process of receiving Benazir Income Support Program payments more simple, safe, and transparent. In the past, many beneficiaries had to wait in long queues at campsites or depend on agents who sometimes deducted money. With this new system, every eligible family can directly receive their installment into their own bank account. This gives people control over their money, reduces fraud, and builds trust between the government and the people.

The concept of the BISP Sahulat Account is similar to a normal bank account, but it is specifically designed for beneficiaries of the Benazir Income Support Program. This account ensures that women, especially from low-income households, can access their funds anytime through ATMs, bank branches, or even mobile banking apps. This step is seen as a milestone in Pakistan’s digital financial inclusion journey.

Why BISP Sahulat Account 2025 is Important for Families

For many poor households in Pakistan, the BISP installment is not just financial aid; it is their lifeline. With rising inflation, daily household expenses, children’s school fees, and medical costs, timely access to this support is crucial. Before the introduction of BISP Sahulat Account 2025, people had to depend on physical cash distribution. This caused several problems like:

- Long travel to payment centers.

- Agents taking unfair deductions.

- Delays in payment transfers.

- No clear record for beneficiaries.

Now, with the Sahulat Account, beneficiaries get full transparency. Every rupee comes directly into their account without deductions. They can withdraw money whenever they want instead of waiting for specific dates. This also encourages financial discipline and allows women to save money for emergencies.

How to Open BISP Sahulat Account 2025

Opening the BISP Sahulat Account 2025 is very simple. The government has partnered with major banks in Pakistan to facilitate this process. Beneficiaries can visit their nearest branch to open an account under this scheme.

Required Documents for Account Opening

To open your BISP Sahulat Account, you must have:

- Original CNIC (Computerized National Identity Card).

- BISP beneficiary status verification (through 8171 SMS or official letter).

- Mobile phone number registered in your name.

- Two passport-size photographs (in some banks, this may not be required).

Step-by-Step Process to Open Sahulat Account

- Visit the nearest participating bank branch (HBL, Bank Alfalah, Meezan Bank, or UBL).

- Take your CNIC and request the officer for BISP Sahulat Account opening.

- Fill out the account opening form with your basic details.

- Provide biometric verification through NADRA.

- Link your mobile number to receive SMS alerts.

- Once verified, your Sahulat Account will be activated.

- You will receive your ATM card or mobile banking access (depending on the bank).

You Can Also Read : Important Changes on 8171 Web Portal 2025

How to Receive BISP Payment in Bank Account

Once your account is active, the process of receiving your BISP installment becomes very easy. The money will be directly transferred into your BISP Sahulat Account 2025. You will also get an SMS notification from 8171 or the bank confirming the deposit.

Different Ways to Withdraw Money

- ATM Machine: Insert your ATM card, enter your PIN, and withdraw the required amount.

- Bank Branch: Visit the branch, show your CNIC, and withdraw cash from the counter.

- Mobile Banking App: If you have a smartphone, you can check your balance and transfer funds.

- POS Agents: Some banks allow money withdrawal through shopkeepers with POS machines.

This flexibility allows families to access funds in whichever way is most convenient for them.

Comparison Between Old System and Sahulat Account 2025

| Feature | Old BISP System | BISP Sahulat Account 2025 |

| Payment Method | Campsites & Agents | Direct Bank Transfer |

| Risk of Deduction | High (by agents) | Zero |

| Access to Money | Only on specific dates | Anytime through ATM or Bank |

| Transparency | Low | High (SMS alerts & bank record) |

| Women’s Financial Freedom | Limited | Improved with direct control |

Benefits of BISP Sahulat Account 2025

The benefits of this scheme are huge, especially for poor families and women. Some of the most important advantages include:

- Full control: No agent or middleman can deduct money.

- Safety: Payments directly transferred to the beneficiary’s account.

- Flexibility: Withdraw anytime, no need to wait for specific camp dates.

- Transparency: SMS alerts and digital record keep everything clear.

- Financial Inclusion: Women from low-income groups now become part of the formal banking system.

- Savings Option: Beneficiaries can keep money in their account for future needs.

Important Tips for Beneficiaries

While the BISP Sahulat Account 2025 is a big relief, beneficiaries must be careful while using their account. Always remember these points:

- Never share your PIN code with anyone.

- Always keep your registered mobile number active.

- In case of any issue, directly contact your bank branch.

- If your CNIC is expired, renew it before applying for account opening.

- Keep SMS records safe for future reference.

You Can Also Read : Punjab Agriculture Internship Phase 2,

Conclusion

The launch of BISP Sahulat Account 2025 is a major step toward empowering poor families, especially women, in Pakistan. It has ended the long waiting queues, removed the role of unfair agents, and given people direct control over their money. Beneficiaries can now easily open an account, withdraw cash anytime, and even save for emergencies. If you or someone in your family is a BISP beneficiary, it is highly recommended to open a Sahulat Account and enjoy this new facility.

FAQs

Can I open BISP Sahulat Account 2025 in any bank?

No, you can only open this account in banks partnered with BISP like HBL, UBL, Meezan, and Bank Alfalah.

What if I don’t have a mobile phone?

You can still open an account, but having a mobile number helps you receive SMS alerts about your payments.

How will I know if my payment has been transferred?

You will get an SMS from 8171 or your bank. You can also check through ATM or mobile banking.

Can I save money in the Sahulat Account?

Yes, this account works like a normal bank account, so you can save money for future needs.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.