Maryam Nawaz Loan Scheme 2025

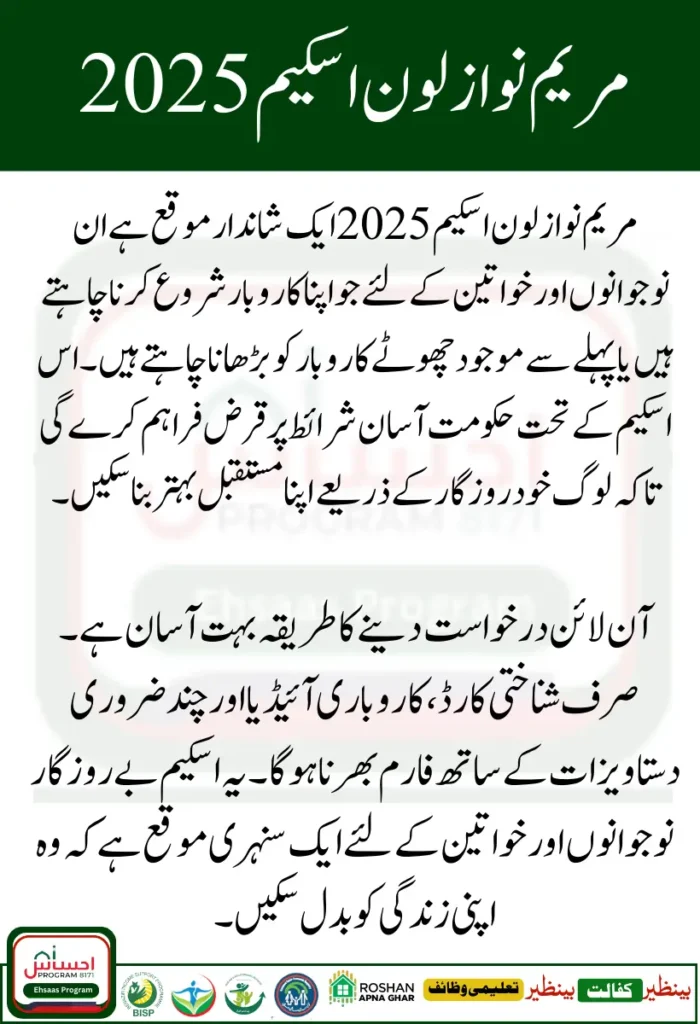

In 2025, the Government of Punjab introduced a new financial initiative called the Maryam Nawaz Loan Scheme 2025. This program is designed to empower youth, small business owners, and women entrepreneurs by providing easy loans to start or expand their businesses.

With the growing challenges of unemployment and inflation in Pakistan, such schemes are considered a lifeline for thousands of families who want to earn with dignity instead of waiting for jobs.The Maryam Nawaz Loan Scheme 2025 is particularly focused on promoting self-employment.

The idea is simple: instead of giving temporary cash handouts, the government wants to help people build long-term sources of income. The loans are available in different categories, from small startups to medium-sized businesses, and the application process is made easy with an online portal.

You Can Also Read : CM Punjab Laptop Program 2025

Why the Maryam Nawaz Loan Scheme 2025 is Important

Unemployment in Pakistan, especially among educated youth, is a major concern. Every year thousands of graduates complete their degrees but fail to secure jobs. On the other side, women, especially in rural areas, have skills like stitching, handicrafts, or small-scale farming but lack financial support to turn those skills into income.

The Maryam Nawaz Loan Scheme 2025 plays an important role here:

- It gives youth a chance to start their own businesses.

- It supports women by offering them equal opportunities.

- It encourages entrepreneurship, which leads to job creation.

- It reduces dependency on government jobs.

- It helps Pakistan’s economy grow by supporting small businesses.

This program is not just about loans; it is about changing the mindset of society from job-seekers to job-creators.

Eligibility Criteria for Maryam Nawaz Loan Scheme 2025

Before applying, it is important to understand who can benefit from the Maryam Nawaz Loan Scheme 2025. The government has kept the conditions simple so that maximum people can apply.

Who Can Apply?

- Pakistani citizens with valid CNIC.

- Age between 18 and 45 years.

- Male and female applicants are both eligible.

- Students with business ideas.

- Women entrepreneurs (priority will be given to them).

- Skilled workers and small business owners.

- Applicants must not have defaulted on bank loans previously.

This wide eligibility makes the scheme accessible for almost every deserving family in Punjab.

You Can Also Read :How to Apply for PM Electric Bike Scheme 2025

Required Documents for Maryam Nawaz Loan Scheme 2025

When applying online, you need to upload some basic documents for verification. Having them ready will make your application faster and smoother.

Documents Needed

- CNIC (Computerized National Identity Card).

- Recent passport-size photograph.

- Proof of education or skill (degree, certificate, or training record).

- Business plan or idea description.

- Guarantor information (if required by bank).

- Mobile number registered on CNIC.

Step by Step Online Application Process

The government has provided an official online portal for the Maryam Nawaz Loan Scheme 2025, which is simple and user-friendly. Here’s how you can apply:

Application Steps

- Visit the official portal for the Maryam Nawaz Loan Scheme 2025.

- Create an account using your CNIC and mobile number.

- Fill in the online application form with your personal and financial details.

- Upload scanned copies of required documents.

- Submit your business idea or loan requirement.

- Select the loan category (small, medium, or startup).

- Agree to the terms and conditions and submit your form.

- Note your application tracking ID for future use.

- Wait for SMS/email confirmation regarding approval.

Table: Key Features of Maryam Nawaz Loan Scheme 2025

| Feature | Details |

| Scheme Name | Maryam Nawaz Loan Scheme 2025 |

| Target Group | Youth, Women Entrepreneurs, Small Businesses |

| Loan Type | Small & Medium Loans |

| Application Method | Online Portal |

| Loan Amount | Different categories (from small to medium) |

| Age Limit | 18–45 Years |

| Required Documents | CNIC, Photo, Business Idea, Education Proof |

| Repayment | Easy Installments |

| Priority Group | Women and Skilled Youth |

Benefits of Maryam Nawaz Loan Scheme 2025

The Maryam Nawaz Loan Scheme 2025 brings several benefits for applicants and society as a whole.

Main Benefits

- Easy access to financial support without heavy interest.

- Empowerment of women by giving them priority.

- Support for educated youth to start businesses.

- Creation of new jobs through entrepreneurship.

- Growth of small businesses in rural and urban areas.

- Simple online application system, reducing paperwork.

This scheme directly supports the government’s vision of economic empowerment and inclusive growth.

You Can Also Read : Benazir Kafalat 13500 Phase 2

Where to Get Help for Registration

If you face issues while applying online for the Maryam Nawaz Loan Scheme 2025, you can get help from multiple sources.

Support Options

- Official loan scheme portal helpline.

- District-level facilitation centers.

- Designated partner banks.

- University career counseling centers (for students).

Conclusion

The Maryam Nawaz Loan Scheme 2025 is an excellent opportunity for Pakistani youth, women, and small entrepreneurs to secure financial support and build a better future. The process is simple, the conditions are fair, and the focus is on empowerment rather than dependency. If you are struggling with unemployment or want to expand your skills into a business, don’t miss this golden chance. Apply online step by step and take the first move toward financial independence.\

You Can Also Read ; BISP 8171 Web Portal 2025 Easy Method

FAQs

Who is eligible for Maryam Nawaz Loan Scheme 2025?

Any Pakistani between 18–45 years with valid CNIC can apply.

Do women get special preference in this scheme?

Yes, women entrepreneurs are given priority.

How much loan can I get from Maryam Nawaz Loan Scheme 2025?

The loan categories vary from small to medium amounts depending on your business plan.

Do I need to provide a guarantor?

In some cases, banks may ask for a guarantor, especially for larger loan amounts.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.