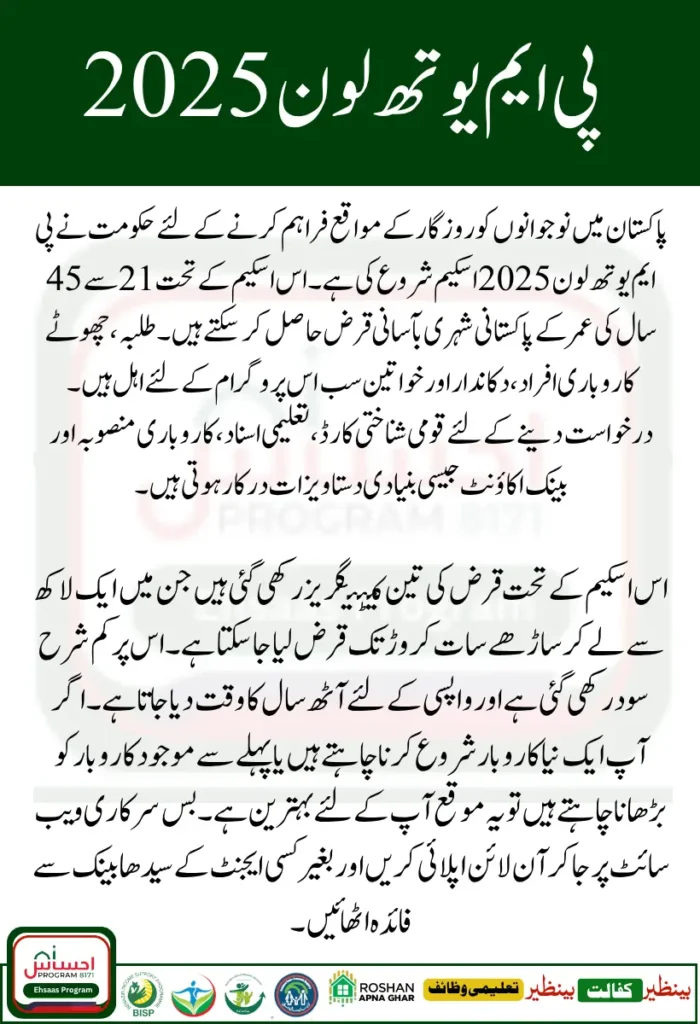

In 2025, the Government of Pakistan once again launched the PM Youth Loan 2025 scheme to support the country’s youth and small entrepreneurs. This loan program is specially designed for people who have business ideas, skills, or want to expand their existing setup but do not have enough financial resources. For a country like Pakistan where youth make up the largest part of the population, such initiatives are considered lifelines to encourage self-employment and reduce unemployment.

The main aim of PM Youth Loan 2025 is to provide easy and interest-subsidized loans to motivated individuals. These loans are not just for highly educated people; even matric pass, diploma holders, and skilled workers can apply. The government has partnered with different banks to ensure that people from urban and rural areas can equally access the loan facility.

You Can Also Read : Asaan Karobar Card Punjab 2025

Who Can Apply for PM Youth Loan 2025?

When the scheme was announced, many young Pakistanis showed interest. However, the government has set some conditions to make sure only genuine applicants apply. The eligibility is wide enough to cover both fresh graduates and small businessmen. Let’s go step by step:

Age Limit and Education

Any Pakistani citizen between 21 years and 45 years of age can apply. For IT and e-commerce businesses, the minimum age is relaxed to 18 years. Education is not a strict barrier. Even if you are a matric pass or only a diploma holder, you can apply as long as you have a clear business idea.

Gender Inclusivity

The scheme strongly encourages both men and women to apply. In fact, women entrepreneurs are being given special preference to promote female-led businesses in Pakistan.

Employment Background

It doesn’t matter if you are unemployed, already doing a small job, or running a small business. As long as you can prove that you will use the loan for a productive purpose, you can apply. Farmers, shopkeepers, freelancers, and students planning startups are all included.

Pakistani Citizenship Requirement

The applicant must be a valid Pakistani citizen with a CNIC. Overseas Pakistanis living abroad are not eligible unless they are permanent residents in Pakistan and meet the requirements.

You Can Also Raed : Punjab Solar Panel Scheme 2025 Latest

What Documents Are Needed for PM Youth Loan 2025?

To apply successfully, you need to have proper documentation. Many applications are rejected because people either submit incomplete forms or miss the required documents. Below is the checklist of documents required for PM Youth Loan 2025:

Personal Documents

- Valid Computerized National Identity Card (CNIC)

- Two recent passport-size photographs

- Proof of residence (utility bill, rental agreement, or domicile)

Educational and Professional Documents

- Copies of educational certificates (matric/intermediate/degree, if any)

- Experience or skill certificate (if available, like diploma in technical trade, IT certificate, etc.)

Business-Related Documents

- Business plan or proposal (a simple plan explaining what you want to do, how much investment you need, and how you will repay)

- Quotation or estimate from suppliers (if buying equipment or machinery)

- Registration certificate of existing business (if already running)

Financial Documents

- Bank account details

- Salary slip or income proof (if employed)

- Guarantor’s CNIC copy (in some cases required)

Step-by-Step Process to Apply

To make it easy for everyone, let us break down the application process of PM Youth Loan 2025 in simple points.

Online Application Submission

- Visit the official PM Youth Loan Program website.

- Fill in the online form carefully with your personal, financial, and business details.

- Upload scanned copies of required documents.

- Submit the application and keep a record of the tracking number.

Bank Review Process

- Your application will be forwarded to the partner banks.

- The bank will review your documents and business proposal.

- You may be called for an interview or asked to provide additional information.

Approval and Disbursement

- If approved, the loan amount will be transferred directly to your bank account.

- You will get an official confirmation SMS and email.

- In some cases, banks may provide the loan in installments to monitor progress.

Loan Categories and Repayment

The PM Youth Loan 2025 is divided into different categories so applicants can choose according to their needs.

| Loan Tier | Amount Range | Markup Rate | Repayment Time |

| Tier 1 | PKR 100,000 – PKR 1,000,000 | 0% – 5% | Up to 8 years |

| Tier 2 | PKR 1,000,001 – PKR 5,000,000 | 5% – 7% | Up to 8 years |

| Tier 3 | PKR 5,000,001 – PKR 7,500,000 | 7% – 9% | Up to 8 years |

This breakdown shows that even small shopkeepers who only need 2–3 lakh can apply, while larger businesses requiring crores also have a chance.

You Can Also Read: Asaan Karobar Card Punjab 2025

Benefits of PM Youth Loan 2025

The scheme is not just about money; it’s about building a new culture of self-reliance in Pakistan. Some key benefits include:

- Easy access to interest-subsidized loans

- No requirement of very high education

- Special preference for women entrepreneurs

- Transparent online application process

- Long repayment time of up to 8 years

- Loans available for both new startups and existing businesses

Key Points to Remember Before Applying

- Make sure your CNIC is valid and not expired.

- Prepare a clear business plan in simple language.

- Do not submit fake documents, as the bank verification is strict.

- Keep a guarantor ready if the bank requires.

- Apply only through the official website and avoid agents or middlemen.

FAQs

Can students apply for PM Youth Loan 2025?

Yes, students who are 18+ and have a business idea (like IT freelancing, e-commerce, or startups) can apply.

Do I need a guarantor to get the loan?

In some cases, yes. For larger loans, banks may ask for a guarantor, but for smaller amounts, it is not always required.

Can women apply for this loan scheme?

Absolutely. Women are highly encouraged and are given priority in the PM Youth Loan 2025 program.

How long does it take to get approval?

It usually takes 30 to 45 days, depending on bank verification and the completeness of your documents.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.